I propose to deal with the report of the “world government” themselves, and at the same time help you translate the original source.3.13 Voluntary Investments

Traditional investing is practiced and taught in business schools in terms of how to use money to buy a financial product, company stocks, or other valuables, such as real estate, goods, or art. The goal of traditional investing is to generate financial returns. This purely monetary profit today has become the only criterion for evaluating investment success.

Somehow, our society began to value cash more than justice, social consequences, or the environment. In addition, thanks to recent quantitative easing, central banks were able to print huge amounts of money to fuel the economy.

However, a lot of “cash is rotting in vaults,” as one corporate officer said, while the cash value of some technology companies passes through the roof. For example, some technology startups have reached the status of "unicorn" with estimates above $ 1 billion in private markets. As of the end of 2015, 146 private technology companies were estimated to be more than twice as high as in 2014; and 14 private companies received valuations in excess of $ 10 billion, and are called decacorns. Some of them have gained immense public acclaim, in particular, WhatsApp, a service company with an annual income of about $ 20 million, acquired by Facebook in 2014 for $ 19 billion, which exceeds Iceland’s gross domestic product (GDP) for the same year.

3.13.1 From Wall Street to Philanthropy

On the opposite side of the non-profit investment spectrum is philanthropy, which traditionally aims to balance social injustice and environmental degradation with altruistic concern about endowing institutions and people's generosity. According to the US, the Americans, who created an extraordinary volunteer culture, donated about $ 358.38 billion to charity in 2014. Most of this amount comes from private donations ($ 258.51 billion); funds ($ 53.97 billion); testament ($ 28.13 billion); and corporate donations ($ 17.77 billion). About a third of this amount is for religious purposes, followed by education, human services, health care, the arts, the environment and social problems. However, this kind of donations are mainly aimed at meeting national needs. Few donations are for global issues.

The oath of gift, launched in 2010, is another example. This is the answer of forty of the richest families and people in the United States to the search for humanity solutions to today's problems. These efforts are worthy and urgently needed, yet philanthropy is struggling with its own problems. The modern charitable landscape suffers from outdated legal and administrative structures. The main reason is that each year only about 5% of donations from most charities are associated with programs, that is, they are dedicated to a charitable mission and are managed by program managers. Ninety-five percent of a fund's assets are usually managed by an independent legal entity (often a trust), mainly obliged to maintain and increase them over time, unless otherwise provided by the founders.

Asset managers are usually rated for their financial success, and not for the success of their charitable mission. Therefore, most of the charitable capital is transformed into regular capital, often invested in companies that produce products and services that work against the charitable mission. Without major legal changes and structural changes, the current paradoxes between making charitable contributions to make the world a better place and investments that really harm it will continue.

This is the case with the Bill and Melinda Gates Foundation, the second most generous philanthropists in America after Warren Buffet. While its founders really care about their influence in the world and pledged to spend all their resources for 50 years after their death, the Gates Foundation was widely criticized for the mismatch between this philanthropic mission and the investments made by their foundation, which obviously serves only maximize their return on investment. According to Piller, etc., in 2007, the Gates Trust invested in pharmaceutical companies that evaluate drugs beyond the reach of poor patients and kept large assets in terrible polluters. They also acquired 500,000 shares (or about $ 23.1 million) of Monsanto, known for their contempt for the interests and well-being of small farmers and for their poor environmental record. Of course, there are many more such examples of less visible charitable foundations.

Very few financial products currently available contain characteristics of long-term sustainability — because they are currently labeled as “external factors,” that is, they do not deserve any financial consideration. in section. 1.1.2, Messages, etc. ... were quoted, showing that about 98% of international financial transactions are essentially speculative, since they are not used to pay for goods and services. And speculations, as a rule, have very short time horizons, which we have shown can be so destructive for our collective future.

3.13.2 Current Structural Changes

In an attempt to remove obstacles to a sustainable financial future, the association, which governs the principles of the United Nations Responsible Investment (UNIDA), summarized key areas in which change and prevent future disparities should be encouraged: short term, negligent environmental and social criteria, lack of transparency and inattention to relevant external factors.

The global implementation of such initiatives remains a gigantic task, which naturally leaves many questions unanswered. Fortunately, however, transformational changes in the investment industry are gaining momentum, and there are many investment initiatives aimed at ensuring integrated sustainability, some of which are highlighted below. Part of the motive, of course, is the restoration of public confidence after the failures of the financial industry in recent years.

For example, during the Rio + 20 Earth Summit in Rio de Janeiro in 2012, 745 voluntary commitments were made, 200 of which were made by business and financial circles. One of these is the Natural Capital Declaration (WPC), a financial sector initiative that was jointly convened in 2012 during this summit by the UNEP financial initiative and the global Canopy program. It was approved by the managers of 42 banks, investment funds and insurance companies. It aims to confirm the importance of natural capital, such as soil, air, water, flora and fauna. Its goal is to integrate natural capital into investment recommendations and solutions, as well as products and services (loans, stocks, bonds and insurance products), as well as its signatories.

In addition, since natural capital is viewed primarily as a free good available to all mankind, the signatories turned to governments to act quickly to develop clear, reliable and long-term policies, support and encourage organizations, including financial institutions and report on their use of natural capital and topics most seek the internalization of environmental costs'. According to Thomas Piketty, the real public debt we have is a debt to our natural capital, and ordinary estimates, such as gross domestic product (GDP), are blind to this danger, as are the falsified returns of most economic sectors, like Pic. 1.11 illustrates. The fact that GDP does not in any way integrate natural capital is dangerously wrong and is the main reason for the initiative of the European Commission "beyond GDP" and other parallel attempts to correct the measurement of progress (see 3.13).

The private sector and the investment community have begun to recognize that their long-term benefits depend on correcting the meaning of the word “progress”. The Global Alliance for Value Development (GABV), an independent network of 30 of the world's leading valuable and sustainable financial institutions, adopted the principles of sustainable banking, which establish a triple bottom line of commitment to people, the planet and prosperity. In its report on the real sector of the economy for 2014, GABV estimated the activities of its banks for 10 years since 2003 and demonstrated how these figures destroy the myth that the problems of resilience and resiliency, as well as the expansion of social rights and opportunities will lead to lower profits. In fact, they demonstrate a higher level of credit and deposit growth than traditional banks.

3.13.3 Impact Investing

A noticeable progressive solution for investors who want to integrate their values with their investment decisions appeared in 1985, when the Vansity Credit Union in Canada responded to investors' demands for more sustainable investment opportunities by introducing the first ethical mutual fund. This foundation has added ethical, social and environmental criteria to its rating indicators. This action marked an important transition from traditional investing, with its focus only on profits, to Impact Investing, which also includes people, the planet and profits in its success indicators. The influence of investment emerged, although it was baptized only with the term in 2007 during the Bellagio summit organized by the Rockefeller Foundation.

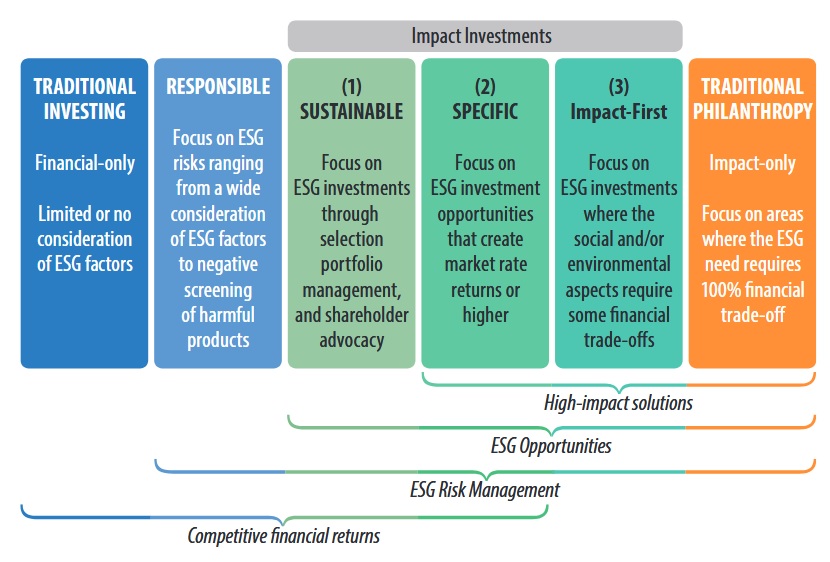

An important aspect of investing impact that could ensure its early adoption and evolution in all asset classes is investor commitment to measure and report impact (people, the planet, and prosperity), as well as ensure transparency and accountability. In Figure 3.14, positions affect the investment between traditional investment and philanthropy and include investment criteria, metrics, and risk factors for the return of its sibling approaches, known by many names, which include sustainable investment, socially responsible investment (SRI), sustainable and responsible investment, investment, program-related (PRI) and investment (MRI).

The impact of investments has been driven and very popular among individual investors and the family business due to its progressive thinking and freedom from regulatory obligations. However, institutional investors also accepted and contributed to its success. Most market participants, if they are not privately owned, have fiduciary duties and must provide market financial returns and only financial returns. Thus, the financial performance of investment impact is still the key to its widespread adoption. The good news is that investments using some environmental, social and management criteria (ESG) amounted to 21.4 trillion US dollars worldwide in 2014.

Figure 3.14

Figure 3.143.13.4 Becoming a mainstream is key

In order for this industry to grow dramatically, it must become mainstream through better risk mitigation and higher integration of more easily measurable criteria. This will allow major investors, such as large institutional investors currently managing more than $ 20 trillion global assets, to participate. The recognition of this category of investors would help legitimize investment in other financial institutions, intermediaries, as well as politicians.

All players, including governments, middlemen, progressive investors and businesses, seem to be moving in the right direction. In June 2013, the G8 / G20 Task Force on Social (and Environmental) Investment Implications (currently superseded by the Global Social Impacts (GSG) Global Investment Steering Group), was initiated by David Cameron, then Prime Minister of the United Kingdom, and Sir Ronald Cohen leadership. GSG has the potential to transform our ability to build a better society for all. This initiative has already had a significant impact on initiatives and regulations implemented by governments around the world.

In October 2015, there was a significant leap forward when Thomas Perez, then Secretary of the US Department of Labor, “abolished the restrictive leadership that prevented pension funds from participating in investing influence”. Progress has been made in the regulation of charitable activities. As of September 18, 2015, the US Internal Revenue Service (IRS) issued a new provision that allows funds to invest their trust assets in mission-driven organizations, in accordance with the purpose of the fund, without fear of penalties for accepting lower financial income. However, the investment community on impact issues is now with some concern about policy changes caused by recent changes in the elections in the UK and the United States.

3.13.5 Green Bonds, Crowdfunding and Fintech

A benign investment is not only a topic for institutional and other professional investors. Another idea is green bonds, designed to provide a low carbon transition. These bonds are a financial instrument that can be used to finance green projects that bring environmental benefits. Annual issuance increased from $ 3 billion in 2011 to $ 95 billion in 2016. In 2016, Apple released US $ 1.5 billion of green bonds to help finance the use of "green" materials and energy efficiency, such as renewable energy for data centers, becoming the first technology company to issue such bonds. In 2016, the first issue of municipal “green” bonds in Latin America (Mexico) was also held, which collected US $ 50 million to pay for energy-efficient lighting, transit modernization and water infrastructure. In 2017, the French government announced the largest sovereign green bond issue to date, 7 billion euros, to finance the energy transition.

The 2017 OECD report says that by 2035, green bonds will have the potential to increase to $ 4.7–5.6 trillion in outstanding securities and $ 620–720 billion in annual output in at least three key areas. sectors in the EU, USA, China and Japan.

These are all mostly conventional investments. However, sometimes it is the outsiders and marginal players who come up with excellent solutions to pressing problems. But such people have difficulty finding businesses, government agencies, or professional investors who are ready to fund the most important early steps to implement their ideas.

Crowdfunding, which uses electronic media to stimulate investment, is a fashionable and encouraging way out of this problem. It originated in the late 1990s, starting mainly with music and other arts, and turned into a completely new universe of funding opportunities for individuals and organizations. One environmental example can serve to illustrate the idea of how it can benefit the earth.

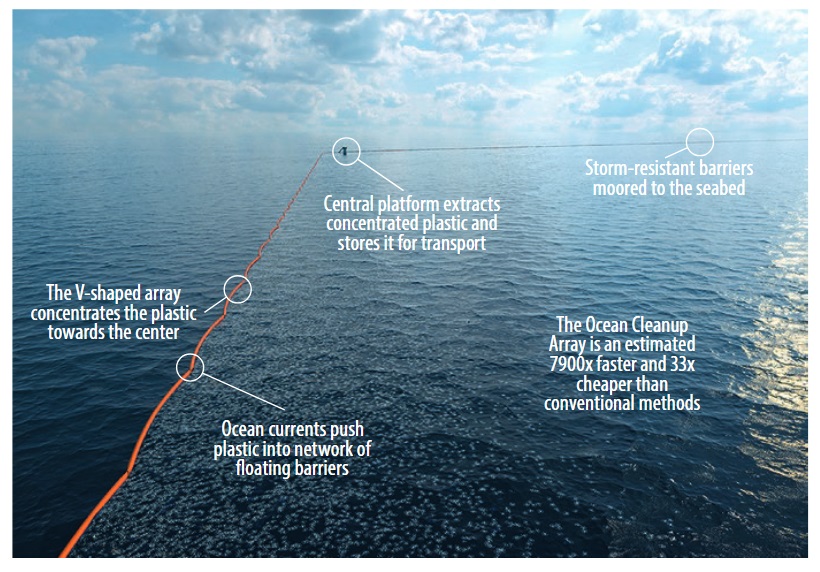

Decades of plastics have led to catastrophic pollution of our oceans. Millions of tons of plastic waste accumulate and are mainly concentrated in five large rotating currents called circles.

Off the coast of California is now about six times more plastic than zooplankton - by dry weight. People around the world began to complain, but no solutions were found. And then an 18-year-old Dutch boy, Boyan Slat, appeared who invented a device for concentrating and trapping plastic garbage driven by ocean currents.

Figure 3.15

Figure 3.15Figure 3.15 shows the size of the circuit. Slat used crowdfunding to raise more than $ 2.2 million to fund implementation and prototyping to reduce plastic pollution in the oceans. Sharing his concept publicly meant that his projects were challenged by others, with the result that the technical process was refined and tested in increasingly large demonstrations. The first functional prototype is being built off the shores of the Tsushima Strait in Eastern Japan.

Another approach to linking finance to technology is Fintech. It is designed to make financial services more efficient and reliable, but also offers a solution that can be a gradual, radical and destructive innovation. How far it goes depends on the further development of its applications, processes, products and business models in the financial services industry. The core banking service is to ensure trust between members, as well as trading arrangements that provide various financial services.

Previous technological advances have reduced the entry barrier for the financial business, increasing the number of participants for both experienced and inexperienced people. The financial system today is influenced by the blockchain technology, which emerged from the philosophy of decentralization and has the potential to shake the current banking system to its foundations. Both the venture capital spent on Fintech startups and the first experiments with new technologies, such as blockchain or Ethereum, indicate that the revolution continues. At the beginning of 2016, the R3 CEV blockchain consortium announced its first experiment with a distributed ledger using Ethereum and the Microsoft Azure blockchain as a service, involving eleven of its member banks.

The basic philosophy is to create trust with decentralized and general information that will destroy the information asymmetry between business transactions. Since each block protects and blocks the previous block, it is impossible to change the previous one. A chain of trust is created that reduces the risk and temptations of fraud. If open and symmetric chains of trust can be implemented as proposed with the blockchain technology, the game of finances can be changed.

To be continued...For the translation, thanks to Jonas Stankevichus. If you are interested, I invite you to join the “flashmob” to translate a 220-page report. Write in a personal or email magisterludi2016@yandex.ruMore translations of the report of the Club of Rome 2018

ForewordChapter 1.1.1 “Different types of crises and a feeling of helplessness”Chapter 1.1.2: "Financing"Chapter 1.1.3: “An Empty World Against Full Peace”Chapter 3.11: “Financial Sector Reforms”Chapter 3.13: “Philanthropy, Investment, Crowdsourse and Blockchain”Chapter 3.15: “Collective Leadership”Chapter 3.16: “Global Government”Chapter 3.18: “Literacy for the Future”

"Analytics"

About #philtech #philtech (technology + philanthropy)

#philtech (technology + philanthropy) is an open, publicly described technology that aligns the standard of living of as many people as possible by creating transparent platforms for interaction and access to data and knowledge. And satisfying the principles of filteha:

1. Opened and replicable, not competitive proprietary.

2. Built on the principles of self-organization and horizontal interaction.

3. Sustainable and prospective-oriented, and not pursuing local benefits.

4. Built on [open] data, not traditions and beliefs.

5. Non-violent and non-manipulative.

6. Inclusive, and not working for one group of people at the expense of others.

Philtech's social technology startups accelerator is a program of intensive development of early-stage projects aimed at leveling access to information, resources and opportunities. The second stream: March – June 2018.

Chat in TelegramA community of people developing filtech projects or simply interested in the topic of technologies for the social sector.

#philtech newsTelegram channel with news about projects in the #philtech ideology and links to useful materials.

Subscribe to the weekly newsletter