In the fall of 2017, the President of Russia instructed the Central Bank and the Government to develop legislative measures to regulate the sphere of cryptocurrency and blockchain. According to the list of instructions of the president, the new laws should be earned July 1, 2018.

Six months later, in May 2018, the State Duma of Russia in the first reading

approved the draft laws “On digital financial assets”, “On attracting investments using investment platforms” and “On digital rights”.

Until day X, when the new measures take effect, there is not much time left, and there is not very much clear and structured information about what exactly will change. Therefore, I conducted a small analysis of what awaits the users and participants of the crypto-community of Russia in the near future.

Miners will be forced to pay taxes

Lawmakers are planning to deposit miners to the FTS registry and force them to pay taxes, although “tax holidays” are possible for a period of two to three years - this will stimulate the legalization of business.

In a conversation with a REGNUM journalist, one of the authors of the law, deputy Anatoly Aksakov,

commented on the initiative as follows:

“We believe that miners should be included in the register of the Federal Tax Service and pay taxes. For the legalization of business, it is my opinion, at first, maybe, for two or three years, to establish a moratorium on taxation ... if it is a small business, small amounts, then a simplified taxation system. Big business - the usual taxation, income tax, maybe VAT. "

In this case, the official believes that the authorities have yet to finalize the definition of mining. While the determining factor is the consumption of electricity.

The exchange of cryptocurrency for fiatnye money will control the Central Bank

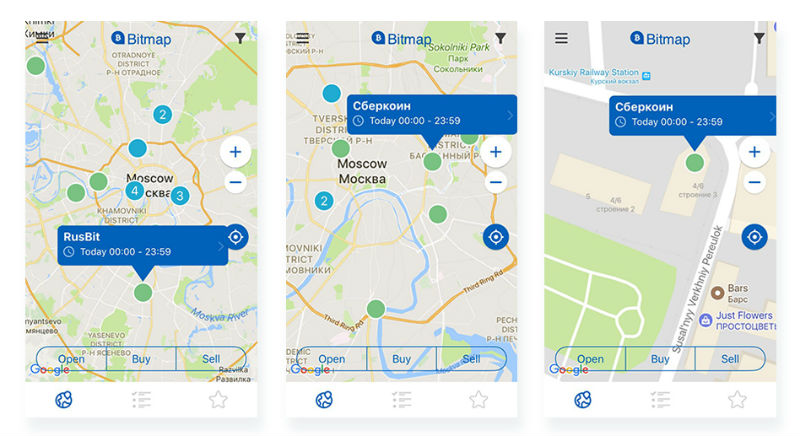

Today, users can exchange cryptocurrency in online exchangers (according

to the Russian Askoin aggregator, there are about 400 of them today), as well as in offices of crypto exchangers or Bitcoin-ATMs - recently journalists, using the specialized search engine

Bitmap, have already found

11 offline exchange

points in Moscow ( all in Russia - about 70).

Map of Moscow crypto exchangers

Map of Moscow crypto exchangersAccording to the theses of the new law, the possibility of exchanging "digital assets" for rubles or foreign currency is allowed. However, the mechanism for regulating this process has not yet been registered -

it says only that "the order and conditions of such transactions will additionally determine the Central Bank together with the government."

There will be "operators of the exchange of digital financial assets"

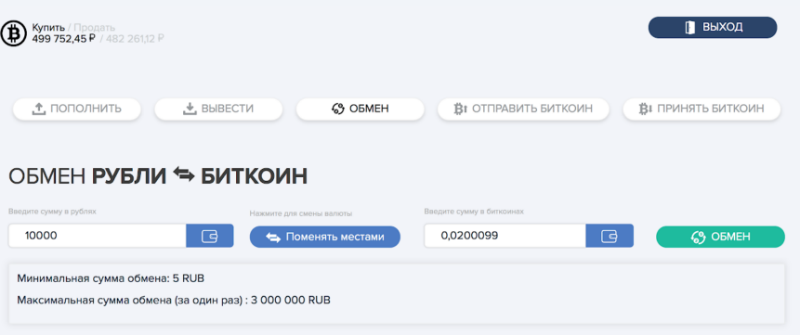

Today there are a large number of ways to buy cryptocurrency - on the exchanges, using bitcoin exchangers or terminals. There are options for services that require verification to perform transactions (for example, the American

Bittrex service), and those where verification is not required (for example, one of the oldest crypto exchangers in

Matbi runet).

Today in RuNet it is easy to buy cryptocurrencies without verification

Today in RuNet it is easy to buy cryptocurrencies without verificationNow, according to excerpts from the bill

published in the Russian newspaper in the winter, it is planned to create special operators of digital financial assets - qualified investors will be able to exchange cryptocurrencies and tokens for other cryptoactive assets only through the accounts of this operator. According

to RBC, the size of the own funds of such operators should exceed 5 million rubles; banks and non-credit financial institutions cannot be such.

ICO tokens will be able to issue only legal entity and SP

In addition, conducting an ICO in order to raise funds on the territory of Russia will be allowed only to legal entities and individual entrepreneurs.

At the same time, qualified investors (a

good article on Banki.ru on how to get this status) will be able to participate in such tokens. For “unqualified” investors (that is, for the majority of the population), the amount of tokens to be acquired will be limited to 50,000 rubles.

Conclusion

New laws received conflicting feedback from participants in the crypto industry.

So in a conversation with Pravo.ru, Igor Sudets, a member of the Expert Council of the State Duma on digital economics and blockchain technologies, also expressed the

opinion that “an attempt to settle all wallets, exchangers and cryptocurrency exchanges will lead to the fact that and just go into the shadow economy. " The expert also doubted that the new laws would create an attractive investment environment in the Russian jurisdiction.

In turn, according to the RBC

quote , the Russian Association of Cryptocurrencies and Blockchains (RACIB) currently does not take into account in any way the laws concerning the acquisition or placement of tokens by Russian legal entities and individuals in foreign jurisdictions. As a result, it will be easier for investors to move to more loyal states, and full-fledged regulation of the industry in Russia will not be introduced anyway.