This material is a conclusion, which, we believe, can be useful to someone. The popularity of the topic of cryptocurrency has led to the fact that even those digital currencies that are not cryptocurrency have become so called. In this article we tried to highlight the basic properties that a cryptocurrency should have, as well as to show the general position of cryptocurrency among all digital assets. So let's get started.

Briefly about the problem

If you study this topic through queries to a search engine, for example Google, then you will get many results in the query “what is cryptocurrency”, in which cryptocurrencies are not distinguished from ordinary digital currencies using the blockchain technology.

Such sources complicate a critical understanding of the topic and lead to various misconceptions that entail a waste of time and money. One of the most common misconceptions among people is the identification of such concepts as “digital currency”, “cryptocurrency” and “token”.

We will not go into details about why we are writing about it and why we need a critical understanding.

What is cryptocurrency?

Here we have tried to give a complete and accurate definition of cryptocurrency.

Cryptocurrency is an independent digital currency in which the processes of issuing, confirming transactions, auditing, storing data and making decisions about updating occur decentralized, anyone can use the currency and participate in the confirmation of transactions, and the price of its coin is formed exclusively by demand and supply in the financial market .

It is decentralization that distinguishes cryptocurrency. If at least one of these processes occurs centrally, then there is no cryptocurrency in front of you. Such a system will not be as stable and reliable as decentralized.

What are the special cryptocurrencies?

Properties. Cryptocurrencies allow for free and reliable transfer, excluding the bureaucratic component, such as registration and restrictions. Anyone can audit all transactions. You do not need to get permission from anyone. The same is true for the confirmation of new transactions. Thus, neither to create new transactions, nor to confirm them, users of cryptocurrency do not need to go through the identification procedure (KYC).

Cryptocurrency is characterized by fully decentralized emissions. New coins in the system should appear according to a specific algorithm that underlies the domestic monetary policy. The price of a coin is formed on the basis of supply and demand only.

We mention voting for updating the protocol and participating in decision-making, since in the conditions of decentralization it is a key nuance that determines the improvement of the currency. The more participants can offer their improvements, the greater the chances for an optimal protocol update.

It is clear that the properties of cryptocurrency can be achieved only under the condition of an open protocol specification, its implementation with open source and with a sufficiently large open community.

If we look at Bitcoin, Litecoin or Monero, then they can be considered cryptocurrency, since all processes in them are decentralized, and the price for currency cannot be dictated by a specific structure - the price is formed according to the laws of free trade.

Other digital currencies

After analyzing, for example, the base currency Ripple (XRP), we see that its issue and confirmation of transactions are carried out centrally (limited by a group of individuals). Therefore, Ripple is simply a digital currency.

A number of other digital currencies also cannot be considered cryptocurrency, since not all processes are decentralized in them: some of them have the opportunity to influence individually.

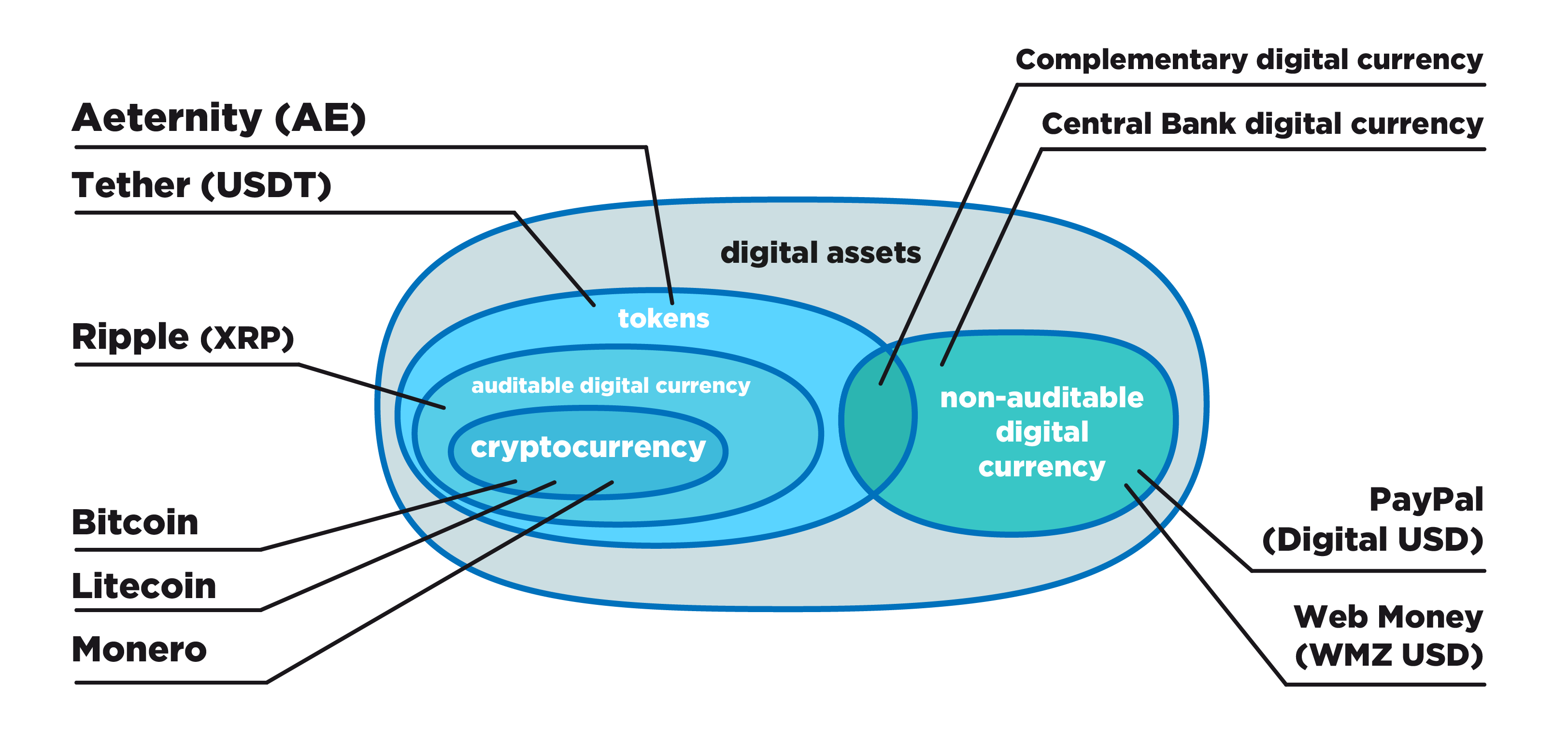

So, we have defined the concept of cryptocurrency in general terms. Now let's look at another type of digital assets - tokens, and define the main features that will help them to distinguish from digital currencies.

Token in a broad sense

Token is not necessarily a currency. In addition, its definition is very abstract and in each case will undergo some contextual changes.

If you think about it, then we are familiar with tokens for a long time. For example, a token in the metro is also a token that gives the right to use the services of the metro, simplifies calculations within the system. The American dollar, up to the moment when the gold standard and the gold peg was canceled, was also a token that implied the right to a certain amount of gold.

The term “token” can also be used in the context of authentication - this is how some identifiers or secrets, which are used for electronic authentication, are called. The token can be in the form of a string or in the form of a small device to confirm access to certain systems, information resources, etc.

Token (digital asset)

Let's try to give the most clear and compromise definition of the token as a digital asset.

A token is a unit of account that is used to represent a digital balance in an asset, and the ownership of the token is proved using cryptographic mechanisms, such as electronic signature.

Such a token, in fact, is an internal unit in some digital accounting system. It is interesting that, depending on the situation, the properties can be inherent to the token:

- shares;

- digital commitment;

- some currency;

- property rights;

- rights to a particular service.

Most often, tokens are recorded in a database based on blockchain technology, and they are accessed through special digital wallets using electronic signature schemes.

Tokens differ from cryptocurrency coins in that they can be emitted both centrally (under the control of one organization) and decentralized (under the control of a predetermined algorithm). If all servers are controlled by a single organization, then transaction processing can be managed by a single organization.

The procedure for determining the price of tokens can depend not only on the balance of supply and demand, but also on additional factors (binding to an external asset, conditional rules of emission or remuneration). In some cases, to obtain the right to conduct transactions with tokens, users need to go through the KYC procedure. As you can see, tokens can be either completely independent or fully controlled.

Conclusion

We have tried to formulate the definition of cryptocurrency, as accurately as possible conveying its essence and properties. Cryptocurrency can only be called a digital currency in which all processes are decentralized (emission, processing of transactions, auditing, data storage, etc.), anyone can own currency and make transactions, and the value of a coin depends only on demand and supply on the market.

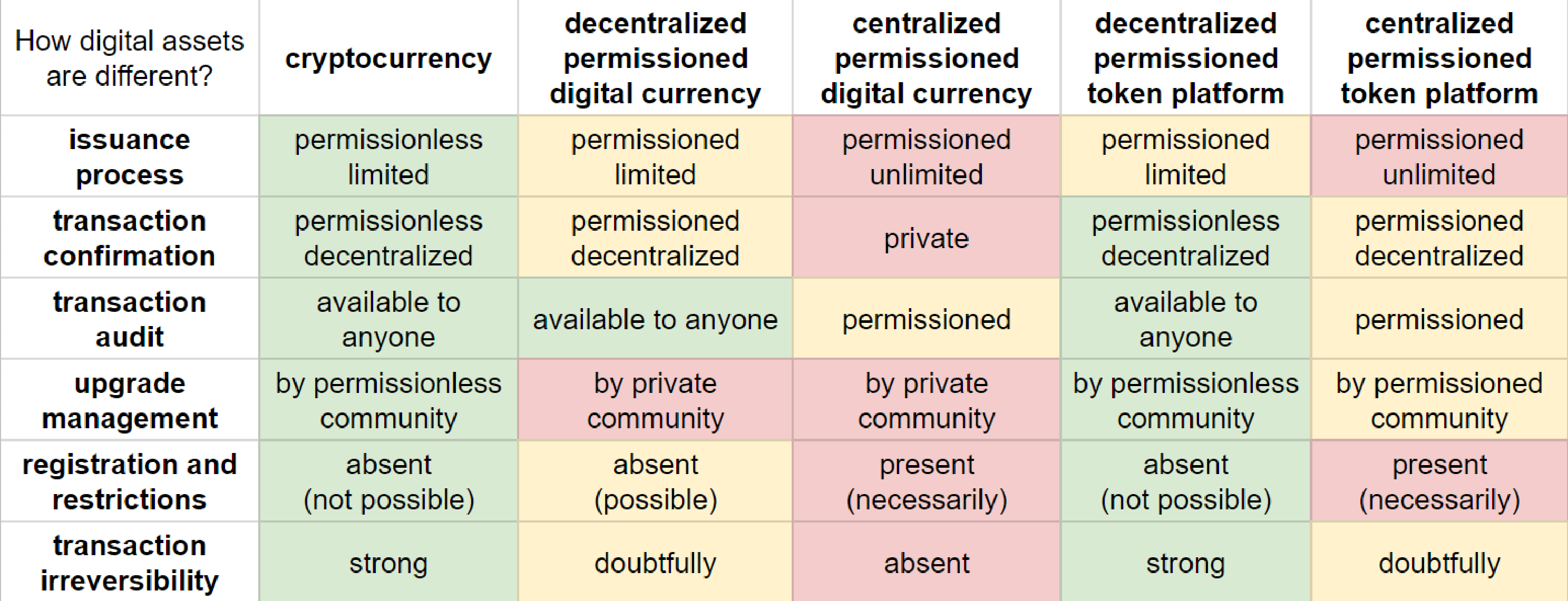

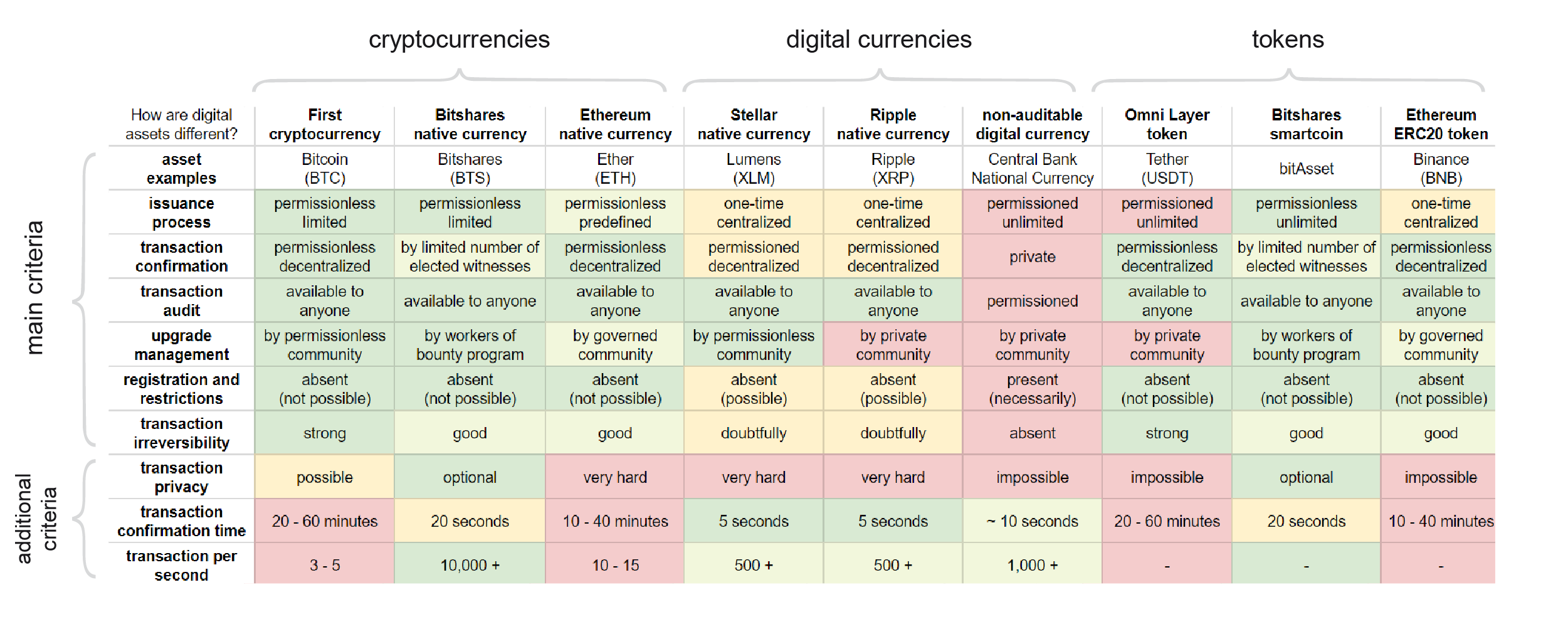

The table below is the result of an attempt to compare the properties of some digital assets from different groups. We believe that it turned out quite clearly.

It would seem that everything in the table is a digital asset, but if you delve into their structure, it turns out that they have very diverse properties. Now, looking at this table, one can clearly formulate the difference between a cryptocurrency and a national digital currency.