A sharp drop in demand for fossil fuels may occur until 2035, say the authors of the new study. Under the threat of assets of oil companies in the trillions of dollars

A sharp drop in demand for fossil fuels may occur until 2035, say the authors of the new study. Under the threat of assets of oil companies in the trillions of dollarsSome large countries, including the United States and Russia, are heavily dependent on the production and export of fossil fuels. The problem is that this source of national wealth is not forever. The current global policy on the spread of low-carbon technologies, energy efficiency and climate can significantly reduce the global demand for fossil fuels, warn the authors of a scientific paper

published yesterday in the journal

Nature Climate Change . The authors of the study warn that the observed transition to alternative energy is contrary to investment in new hydrocarbon fields, which in the end could lead to the collapse of the industry and a serious blow to the global financial system.

The idea is that over a period of several decades, trillions of dollars worth of oil companies' assets can be quite sharply depreciated. Researchers call this perspective the “global bubble of hydrocarbons.” It is possible that the demand for oil and gas will fall sharply, and then it will be hard for everyone.

The authors of the research work use an integrated simulation of the world economy model in combination with environmental protection measures - and the effect of this model on the fossil fuel assets (SFFA) that are at risk.

The analysis showed that a certain part of current assets is already included in the risky SFFA zone

even along the current trajectory of technological development , without taking into account the potential adoption of a new climate policy. The industry’s losses will be significantly increased if a climate policy is adopted to keep the temperature within 2 ° C from the pre-industrial level, as provided for in the Paris Climate Agreement.

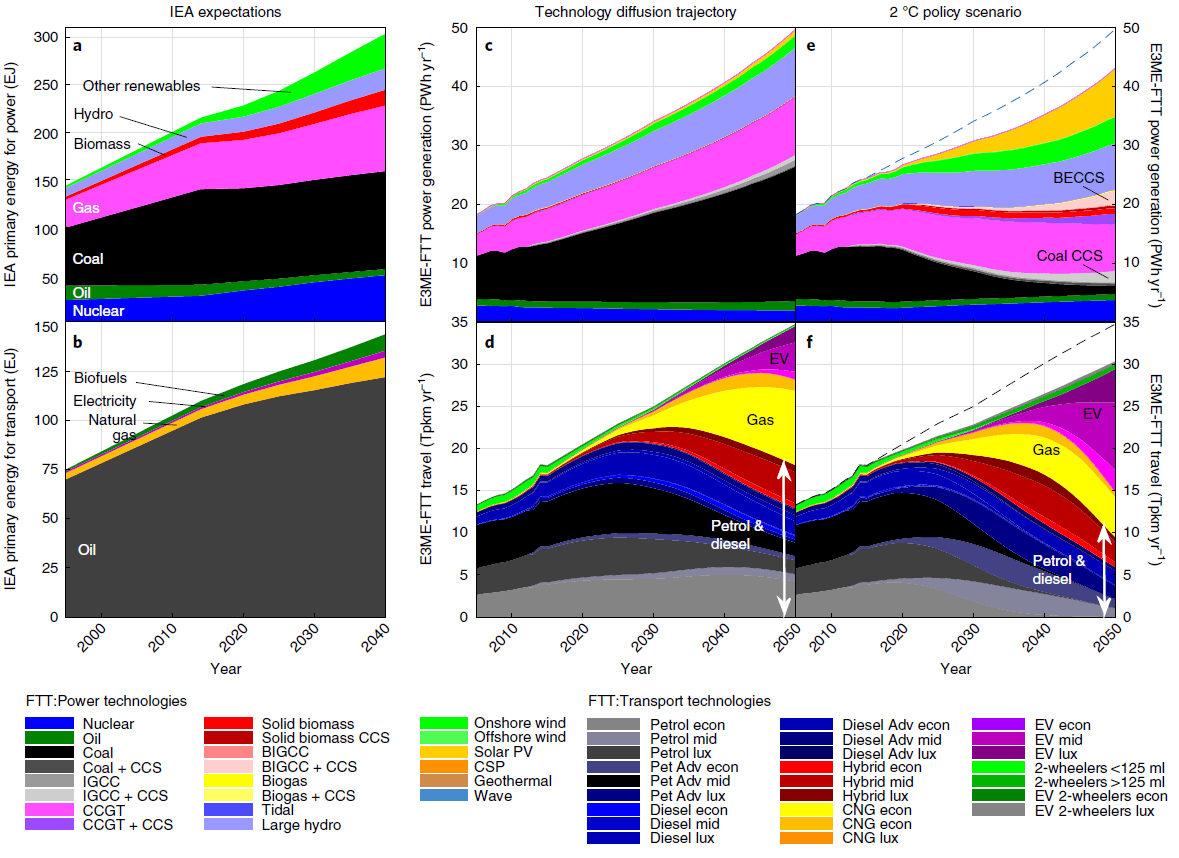

The simulation results are well shown in the following graphs (clickable, legend on the types of fuel below). The two graphs on the left are the long-term forecast of the International Energy Agency (IEA). As you can see, the forecast is very conservative and does not provide for a significant change in the structure of fuel consumed either in the energy sector (above) or in transport (below).

The four graphs on the right side are simulation results that clearly demonstrate what the authors of the study call the “global bubble of hydrocarbons.”

The central plots (c, d) correspond to the forecast of the consumption of different types of fuel in power generation and transport based on the current technological development trajectory. As you can see, even in this scenario, the share of gasoline and diesel fuel in transport is significantly reduced since the second half of the 2020s.

If the Paris Agreement on climate is adopted in the strictest form (some scientists believe that this is the only chance to prevent the onset of an irreversible self-sustaining cycle of global warming up of the atmosphere, that is, the greenhouse effect), then the energy industry can experience a truly crisis scenario. In this case, their losses will increase even more. The multiplication of losses will also happen if some OPEC countries with low oil costs keep production at the current level, despite the future decline in demand.

According to analysts, in this case the loss from SFFA can be from one to four trillion dollars. That is, the global welfare - the value of all global assets and, accordingly, the global economy - will decrease by the appropriate amount. According to researchers, there are clear winners (net importers of fossil fuels), including the EU and China, as well as clear losers, including the United States, Russia and Canada — these countries can lose almost all hydrocarbon exports, which will have a devastating effect on these industries.

It would seem that humanity has no other choice but to save the ecology of the planet - and reduce greenhouse gas emissions. But it turns out that even with such a development of events, individual countries cannot avoid a large-scale crisis. However, at the global level, the negative and positive effects should balance each other, scientists believe.

The scientific article was

published on June 4, 2018 in the journal

Nature Climate Change (doi: 10.1038 / s41558-018-0182-1,

pdf ).